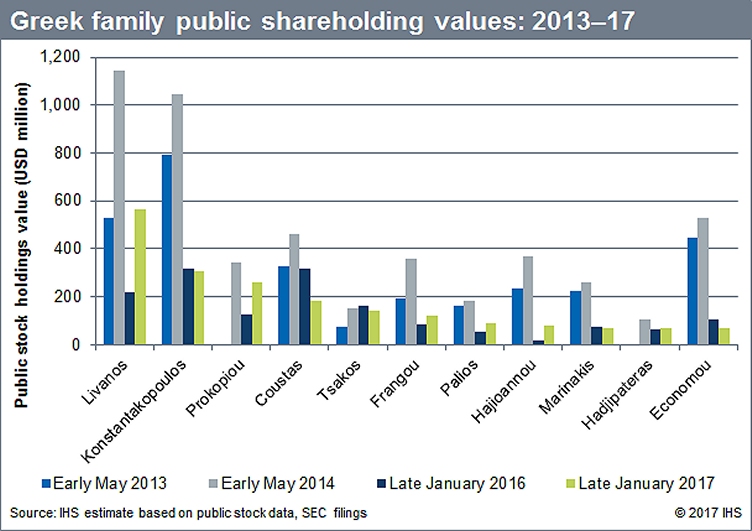

Since the early 2000s, Greek shipowners have been a major presence in the US public markets. The value of Greek family holdings surged towards the end of the 2003–7 shipping super-cycle, slumped in the wake of the 2009 financial crisis, and rebounded to surprisingly lofty levels in 2014, ironically, a year when Greece’s government was in the midst of a severe financial crisis.

In May 2014, IHS Fairplay analysed regulatory disclosures of Greek family holdings in US-listed shipping companies to determine which families held the most significant public stakes, how large they actually were and how they had changed in value over the prior year. To gauge how valuations have trended since then, IHS Fairplay has analysed Greek family holdings of US-listed shipping stocks in January 2016 and January 2017 (see below for details of how holdings were valued).

What the new analysis found – not surprisingly – is that the overall ‘paper’ value of Greek family holdings in US-listed shipping companies has plummeted since 2014, in line with the general decline in shipping stocks overall (see chart above). For the largest Greek families, public values are down by around 60% on average over the past three years. There have also been major shifts in the line-up, including a particularly sharp fall down the list for DryShips founder George Economou.

There are several caveats to the rankings. Declining stock holdings do not necessarily equate to family losses. Greek families often have considerably larger private fleets operating in parallel to their public ventures and a smaller public footprint may be counterbalanced by a larger private one. In addition, a family’s holdings may have declined not only because stock prices fell, but because some of the shares have been sold for cash.

At the top of the current ranking is Peter Livanos of Greece’s famed Livanos shipping dynasty. Livanos’ public shipping holdings, currently valued at USD566 million, are more than double their value a year ago (USD218 million), but less than half of the USD1.14 billion valuation in early May 2014. The pattern of a rising value over the past year but a falling value versus 2014 is commonplace throughput the public shipping space.

Livanos’ public LNG holdings (NYSE-listed GasLog Ltd and GasLog Partners) fell in value along with the price of oil and the valuations of other master limited partnerships in early 2016 and have since rebounded, albeit to levels that are still well above those seen in 2014.

Meanwhile, Livanos cashed out of his last nine million shares in NYSE- and Euronext Brussels-listed tanker company Euronav in November 2015 for around USD125 million. It marked one of two significant Greek sell-outs in recent years. The other occurred in August 2016, when Dimitris Melissanidis sold his entire stake in NYSE-listed bunker supplier Aegean Marine Petroleum Network for USD100 million, exiting the public shipping arena.

According to the IHS Fairplay analysis, the Konstantakopoulos family currently ranks second in terms of public shipping holdings, with USD307 million in stock value, courtesy of its 65% stake in NYSE-listed containership lessor Costamare. This is only a third of the family’s May 2014 public shareholding value of USD1 billion, with the sharp drop due entirely to the decline in Costamare’s stock price.

George Prokopiou ranks third with holdings USD259 million in NYSE-listed Dynagas LNG Partners, although almost all of his holdings are in the form of subordinated units, which the IHS Fairplay analysis has counted at the same value as common units, given the likelihood that they will be converted to common units (the value of Prokopiou’s common units is only USD10 million). As with Livanos’ LNG-linked shares, Prokopiou’s public holdings are up sharply year on year and down sharply from 2014 highs.

Coming in fourth is the Coustas family, which holds a 62% stake in NYSE-listed container-ship lessor Danaos Corp. At USD181 million, the value of the Coustas family’s stock has steadily declined since 2014 as a result of share price declines on weaker container-sector fundamentals and exposure to the Hanjin bankruptcy.

The Tsakos family comes in fifth with USD140 million worth of stock in NYSE-listed tanker owner Tsakos Energy Navigation, followed by Angeliki Frangou, who has direct and indirect holdings in four NYSE-listed companies: Navios Holdings, Navios Partners, Navios Acquisition, and Navios Midstream. Frangou’s public holdings were valued at USD356 million in May 2014, but have come down significantly due to Navios’ dry bulk exposure, to USD199 million currently, despite a modest increase in Frangou’s ownership share in the group over the past three years.

The top 10 in terms of current stock holdings are rounded out by Simeon Palios (NYSE-listed Diana Shipping, NASDAQ-listed Diana Containerships) with USD91 million, Polys Hajioannou (NYSE-listed Safe Bulkers) with USD80 million, Evangelos Marinakis (NASDAQ-listed Capital Product Partners, CPP) with USD70 million, and John Hadjipateras (NYSE-listed Dorian LPG) with USD69.8 million.

For these families, holdings are down from May 2014, largely due to share price declines, but also due to share sales in the case of Marinakis. In May 2014, Marinakis owned 24 million common units of CPP, equating to ownership of 27%. According to the latest securities disclosures, he currently owns 19.8 million common units, equating to ownership of 16.4%.

Just below Hadjipateras, in eleventh place, is Economou with USD69.7 million worth of holdings in NASDAQ-listed DryShips and Ocean Rig UDW and NYSE-listed Danaos as of late January, according to IHS Fairplay estimates based upon the latest securities filings.

At one point, Economou was the most visible Greek shipping magnate on Wall Street, with by far the largest holdings on paper. Near the peak of the shipping boom, on 29 October 2007, DryShips’ stock traded at an all-time high of USD131.34/share and his stake at that time (34.3%) was worth USD1.6 billion. As of May 2014, his stakes in DryShips, Ocean Rig UDW and Danaos were valued at USD530 million, ranking him third among the Greeks on Wall Street.

Based on the latest securities disclosures, Economou’s current common-share holdings in DryShips appear to be under 1%, with new investor Kalani owning over 90% (Economou still controls the company’s voting rights through his ownership of Series D shares).

Economou’s holdings in Ocean Rig UDW are down to USD11.9 million, leaving his Danaos ownership as his largest public shipping investment. His Danaos shares are currently worth USD57.7 million. As Danaos’ share price has fallen, Economou has doubled his ownership from 11 to 22% through USD42 million in share purchases in 2016.

The decreased value of Economou’s stockholdings coincides with a shift in his interests towards his private holdings and towards related-party deals that benefit those interests. When DryShips sold its final Ocean Rig UDW stake in April 2016 for USD50 million, proceeds went to pay back a loan from Economou. In 2015–16, all of DryShips’ tankers and most of its modern bulkers were sold to Economou. Almost all of DryShips’ debt is now owed to Economou, who will earn LIBOR plus 5.5%, and DryShips is now buying a series of very large gas carrier newbuilds for USD83.5 million each from Economou.

In other words, Economou may have a smaller footprint on Wall Street in terms of his stock holdings, but he is still very much in business.

How shareholdings were valued

To estimate the valuation of family shareholdings, IHS Fairplay multiplied the average closing pricing of family-owned stocks during the first five trading days of May 2013 and May 2014 and the five trading days ended 25 January in 2016 and 2017 by the number of shares held by each family at those times. The share count was estimated based on the latest public disclosure with the Securities & Exchange Commission, and included common shares and subordinated shares, but not preferred shares.

In addition to shares directly held by family entities, an effective value was added for shares in daughter companies held by parent companies, to the extent parent companies were owned by sponsoring families.

Source: fairplay.com

Sidebar

19

Παρ, Απρ

Το δανείζει το ΙΣΝ για τους Ολυμπιακούς.

Το δανείζει το ΙΣΝ για τους Ολυμπιακούς.