At the time of writing there were more than 73,000 cases of the COVID-19 virus and more than 1,850 deaths. China, and particularly the Hubei province, is responsible for most of the recorded cases and deaths. The outbreak of the COVID-19 virus has a huge impact on economic life in China with many factories and logistics flows still being affected.

As global supply chains are severely disrupted, production and consumption centres around the world are starting to be affected by the situation in China. Several organisations are keeping track of the rippling effect of the virus on the global container shipping market. The number of blanked sailings out of Chinese ports has reached unprecedented levels in recent weeks. Given the sailing time between Asia and Europe, the full impact of these blanked sailings on European ports will start to become visible only from March onwards. Thus, not only Q1 traffic figures might be impacted, but even more Q2 volumes. It is still early days to assess how long the situation will persist and how many more blanked sailings will be announced in the coming weeks and months. If the situation in China does not normalize by the end of March, the effects on global supply chains could be noticeable till the Autumn or event Winter of 2020. An eventual normalization of the situation in China could lead to a sudden spike in container volumes and temporary vessel capacity shortages.

European ports show different degrees of vulnerability to the effects of the Coronavirus.

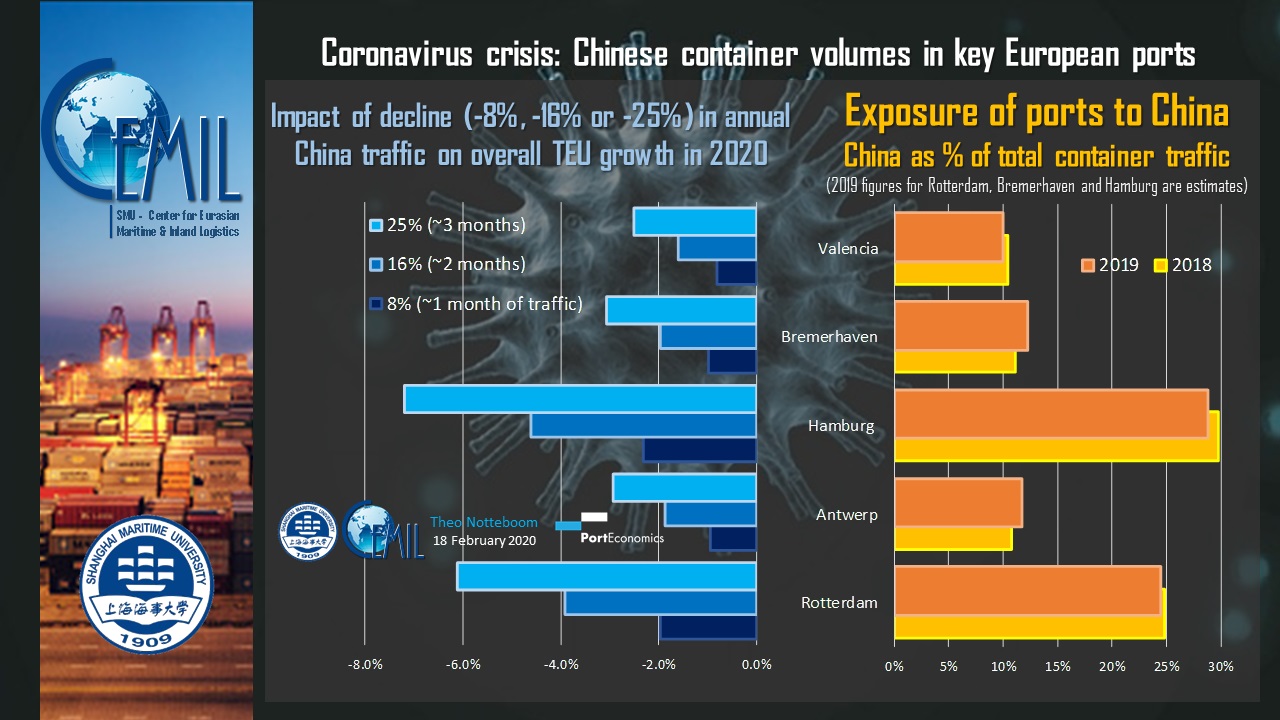

European ports show different degrees of vulnerability to the effects of the Coronavirus. Among the European container ports, Rotterdam (no. 1 in Europe) and Hamburg (no. 3) handle the highest number of containers in relation to China. Moreover, China represent about 30% of Hamburg’s container throughput and about one fourth of Rotterdam’s volume (see graph). These figures do not include intra-European transhipment flows linked to the mainline services from/to China. Europe’s second largest container port, Antwerp, is less exposed to China: 12% of total TEUs handled in 2019. Valencia (no. 5 in Europe in 2019) and Bremerhaven (no. 7) show similar relative dependencies on China.The coronavirus is likely to have a moderate to strong negative impact on China-Europe container trade in 2020. However, the potential impact on European ports will vary greatly. If the Coronavirus crisis would result in an 8% decline of Chinese container volumes in European ports in 2020, then Hamburg would lose a growth potential in 2020 of 2.3 percentage points and Rotterdam about 2 percentage points. Other ports are less exposed with a 0.8 to 1 percentage point loss in growth potential. Obviously, the adverse effects will be much larger if we assume a dramatic scenario leading to an annual decline in Chinese container volumes of 25%. In such a case, Hamburg’s TEU growth in 2020 could be curtailed by 7.1 percentage points, while Rotterdam would be looking at a drop of 6.1 percentage points. For the other ports the figures range between 2.5 and 3.1 percentage points. These are just scenarios. In the coming weeks/months we will be able to measure and analyse the real port-related effects of the virus in China and affected regions in other parts of the world.

Source: porteconomics.eu